Fort Lauderdale Personal Injury Attorneys

Serving Broward County Residents For More Than 40 years

At the law firm of Boone & Davis, Attorneys at Law, our Fort Lauderdale personal injury attorneys are dedicated to helping victims recover for injuries sustained in accidents caused by the negligence or wrongful acts of others. For more than three decades, our Fort Lauderdale injury attorneys have been providing the experienced representation clients deserve to help them obtain the compensation they need after a car or motorcycle accident, medical malpractice injury or other serious accident. Through open communication and accessibility, our legal team has developed a reputation for excellent service among our peers and clients, many of whom refer our firm to others who are injured and in need of assistance.

We Are Committed To Results

Our firm has obtained millions of dollars in jury verdicts and settlements for the benefit of our valued clients. We use our skills and vast resources to help individuals who are injured or who have lost a loved one because of the negligence or intentional acts of others. Our law firm assists with all types of injury and wrongful death cases, from helping you through injuries caused in a slip and fall accident due to the negligence of a landowner to helping you with your medical malpractice claim after you are injured at the hands of a trusted doctor.

Our Fort Lauderdale personal injury attorneys are highly experienced litigators who never hesitate to take your case to court when it is in your best interests. We handle all types of complex, serious injury cases and work with a network of experts, including life-care planners, vocational rehabilitation experts and financial planners, to ensure that you obtain just compensation in your personal injury case, encompassing medical expenses, lost wages and payment for your pain and suffering. Our legal team has a broad range of practice areas:

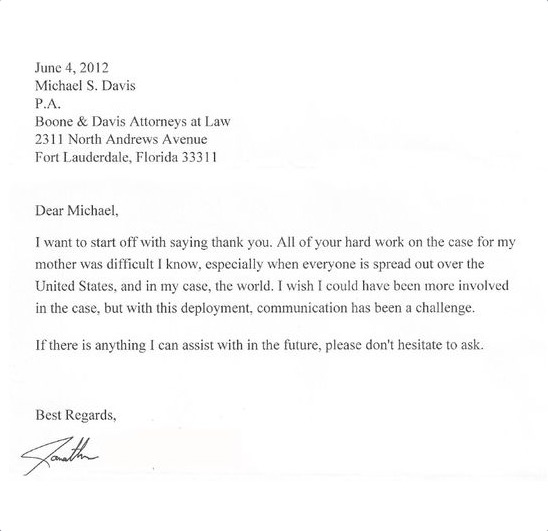

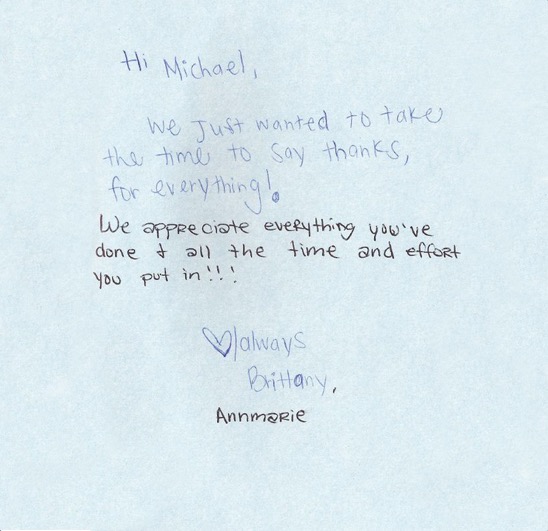

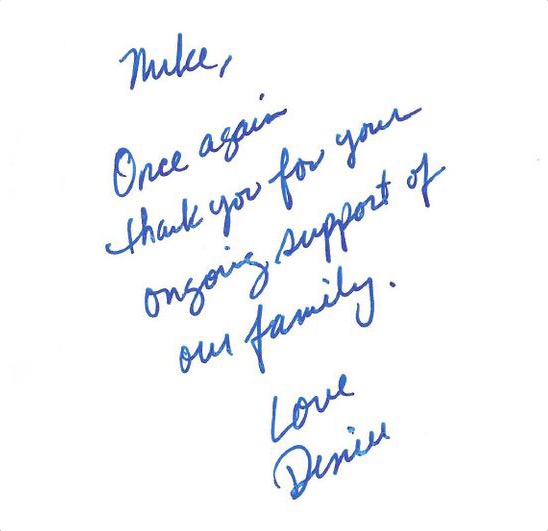

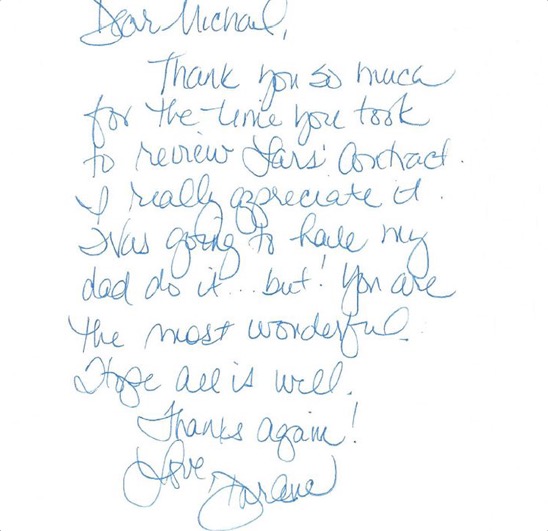

At Boone and Davis, we are at your side through each step of your injury claim after a serious motorcycle, truck or car accident. Firm partner Michael Davis gives clients not only his direct line, but also his cell phone number, so that you can reach him when you need him. As an AV® Preeminent™ Peer Review Rated from Martindale-Hubbell® attorney with a five-out-of-five rating from clients, it is clear that Mr. Davis is a lawyer trusted by many to obtain just results.

Helping You Through Auto Accidents In Fort Lauderdale

Car accidents

Motor vehicle accidents can cause devastating injuries to victims and even result in the loss of a loved one. Whether you were injured in an auto, truck or motorcycle accident, or because of an auto defect, we have the experience, resources and dedication to help you obtain a fair insurance settlement or to aggressively protect your interests in court. We have experience with cases in which the other driver had no insurance or was underinsured, along with hit-and-run accident cases and DUI-related accidents. To learn more about how we can help you and your family, please see our page on motor vehicle accidents.

Whether you have been injured or have lost a loved one in a car accident or a serious motorcycle accident, our Fort Lauderdale auto accident attorneys use skills, experience and commitment to help you recover compensation for all types of motor vehicle accidents, including:

Through reliable, attentive representation, Boone & Davis, Attorneys at Law provides high-quality service to injured victims in Fort Lauderdale and throughout Broward County. If you are seriously injured and cannot come to our office, we provide home and hospital visits on a case-by-case basis. We offer our services on a contingency fee basis, which means that if we do not recover compensation for you, you pay nothing — not even our expenses. To learn more about how we can assist with your case, contact us anytime online or call 954-566-9919 to schedule a free initial consultation.

Premises liability

When the negligence or fault of a landowner causes you to suffer serious injuries, our personal injury attorneys are dedicated to helping you through your premises liability claim to obtain the compensation you need. We assist with cases involving injuries caused by property defects resulting in trip or slip and fall accidents, dog bites and animal attacks, injuries sustained at theme parks and injuries resulting from negligent or inadequate security. To learn more, please see our page on premises liability.

Accident injuries

When an accident occurs, whether it is a car accident, a workplace accident or a slip and fall accident, a serious accident injury may result. Using our legal knowledge and experience, in combination with our network of experts, we help you obtain compensation that reflects the full extent of your injuries, including for both immediate medical care and long-term care. We have significant experience assisting those suffering from all types of injuries, including traumatic brain injuries, spinal cord injuries, burn injuries, complex regional pain syndrome (CRPS) and other catastrophic injuries. In addition to helping people suffering from a serious injury, we also represent families who have lost a loved one in fatal accidents.

Medical malpractice

When a doctor or other medical professional provides a substandard level of care, our medical malpractice lawyers can help you recover compensation to make up for the harm you have been caused. In addition to medical malpractice claims, we also assist with litigation involving dangerous or defective drugs that cause serious illness, injury or death.

Get The Help You Need From Fort Lauderdale Personal Injury Attorneys Dedicated To Just Results

Our Fort Lauderdale personal injury attorneys at Boone & Davis, Attorneys at Law are devoted to providing comprehensive support and guidance when you are injured or lose a loved one because of the negligence of others. For a free consultation, contact our firm anytime online or by calling 954-566-9919. We are dedicated to clear, open communication, and we promptly return your calls. Contact Fort Lauderdale personal injury attorneys with the experience and accessibility to help you achieve results.